Charts

Chart Shows Where Retirement Dreams Meet Financial Reality With State Ranking by Affordability

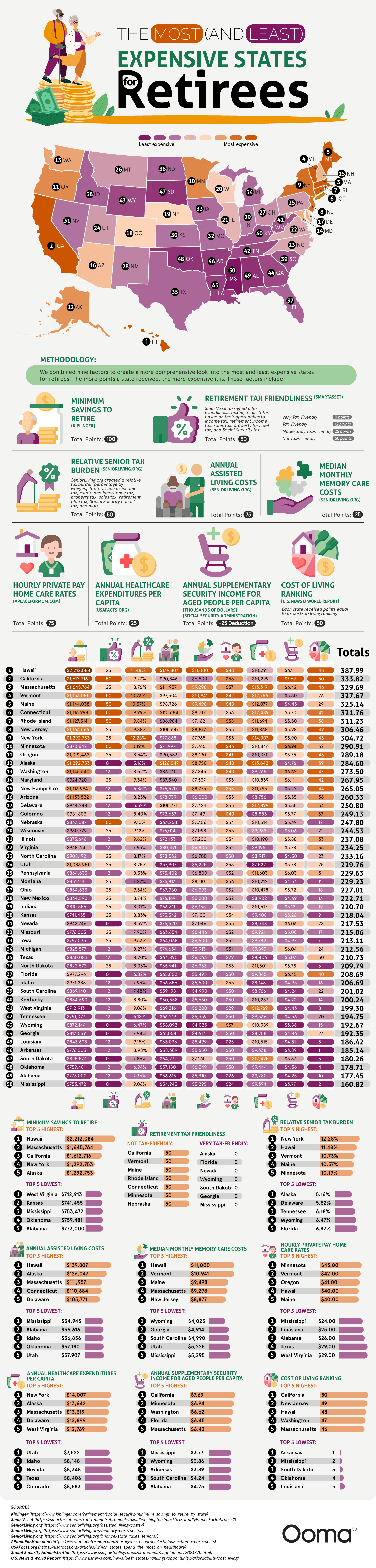

Retirement is a hard-earned chapter of life where older people can escape the daily grind of a busy workweek to focus on their health, relaxation, and quality time with loved ones. While many potential retirees dream of warm weather and sandy beaches, they’re forced to make plans based on financial realities. Many people want to know where they can stretch their savings the farthest. Each state offers its own charms and advantages, but the team at Ooma presents the real financial situation with a ranking by affordability.

Click below to zoom.

A Stark Financial Divide

Ooma’s analysis reveals dramatic differences in cost across each statement in America. They’ve determined the minimum savings needed to get by, and the results ranged from a modest $713,000 in West Virginia to a huge sum of $2.2 million in Hawaii. Their research combined nine factors to create the 400-point scoring system. Categories included savings thresholds, assisted living costs, tax burdens, memory care expenses, healthcare expenditures, and home care rates. Combined, this score reflects the true cost of retirement.

We see Hawaii emerging as the most expensive state to retire in by far. Their geographic isolation drives up the cost of living, which is common for island life. Assisted living costs are staggering, too, at $139,807 per year, and memory care reaches $11,000 a month. These costs can suck up retirement savings fast. California was the second-most expensive state, followed by Massachusetts, which both prove how steep the price of a fun lifestyle or premium healthcare can be.

The Budget-Friendly States

At the opposite end of the spectrum lies Mississippi, the most affordable state to retire in. Assisted living costs about $54,943 a year and home care costs about $25 an hour, which creates a great option for budget-conscious retirees. Alabama and Oklahoma are also on the affordable end of the spectrum, combining low living costs with affordable healthcare and tax-friendly policies.

Tax Policy Makes a Powerful Impact

State tax policies create significant cost differences between states that affect basic living expenses. Seven states on the list earned a “very tax-friendly” status due to eliminating most retirement-related taxes. These states were Alaska, Florida, Nevada, Wyoming, South Dakota, Georgia, and Mississippi. These states don’t tax retirement income or Social Security benefits and have minimal property taxes. On the other end of the scale, California, Vermont, Maine, Rhode Island, Connecticut, Minnesota, and Nebraska have the heaviest tax burdens which can eat up to 10.73% of income. These factors can’t be ignored when considering retirement costs.

Considering Healthcare Cost

Healthcare expenses are significant for aging people, and Utah has the most affordable healthcare, while New York has the most expensive healthcare. However, it’s important to consider that price often reflects healthcare quality. Massachusetts, Connecticut, and New York have the most expensive healthcare but are also the highest rated.

Paying for a Lifestyle

Despite high costs, we can see on the chart that some of the most expensive states are the most popular. Hawaii, California, and Florida are the retirement dream for anyone seeking warm weather and beautiful beaches. Luckily, research like the data presented here can help people effectively plan for whatever retirement future they dream of.