Business Visualizations

The Largest Mergers of All Time, Adjusted for Inflation

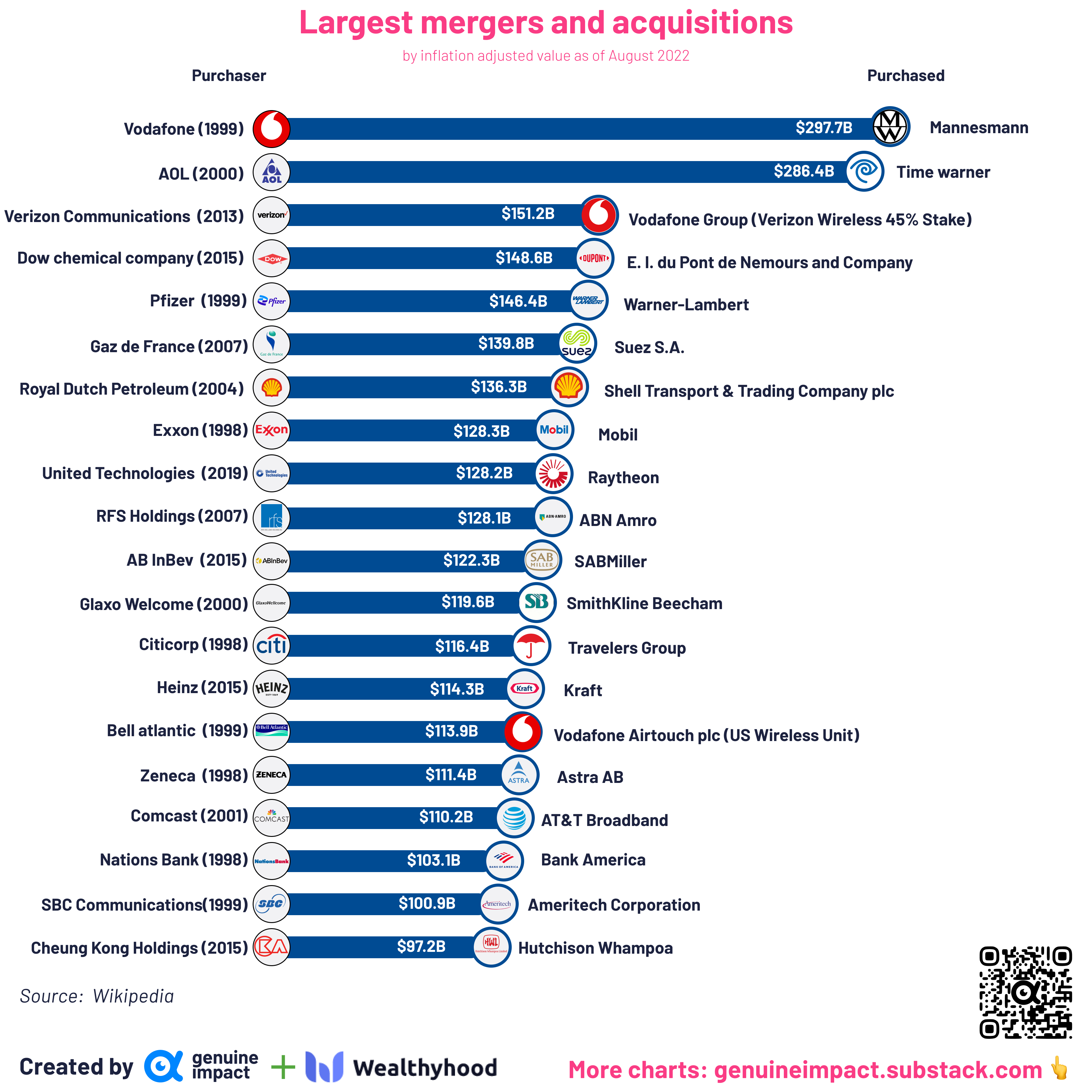

When talking about the world’s largest mergers and acquisitions, it is interesting to see how some companies surged while others have lost so much. According to this visualization, adjusted for inflation in 2022, the largest acquisition was in 1999 when Vodafone purchased German cell company Mannesmann for $297.7 billion dollars. Since that purchase, only the Time Warner acquisition by AOL has even come close, selling for $286.4 billion just one year later in 2000. Read on to learn more in this interesting piece from /u/giteam on Reddit.

Click below to zoom

In 1998, Exxon purchased Mobil for $128.3 billion, which shows the enormity of the Vodafone merger. Another major acquisition on this list by a company you have probably heard of is Kraft, which was purchased by Heinz in 2015 for $114.3 billion. AT&T is another well-known business that was purchased by Comcast in 2001 for $110.2 billion. Travelers Insurance Group was purchased by Citicorp in 1998. Let’s continue down the list to see other major mergers from the past. In 1999, pharmaceutical giant Pfizer purchased Warner-Lambert for $146.4 billion. Gaz de France purchased Suez S.A in 2007 for $139.8 billion. Dutch Petroleum purchased Shell Transport & Trading Company for $136.3 billion in 2004. RFS Holdings purchased ABN Amro in 2007 for $128.1 billion. AB InBev purchased SABMiller for $122.3 billion in 2015. Glaxo Welcome purchased SmithKline Beecham for $119.6 billion in 2000. Bell Atlantic then purchased Vodafone Airtouch for $113.9 billion in 1999. Zeneca purchased Astra AB, becoming Astra Zeneca in 1998 for $111.4 billion. Nations Bank also purchased Bank of America in 1998 for $103.1 billion.