Charts

These Alternative Payment Methods are Replacing Cash

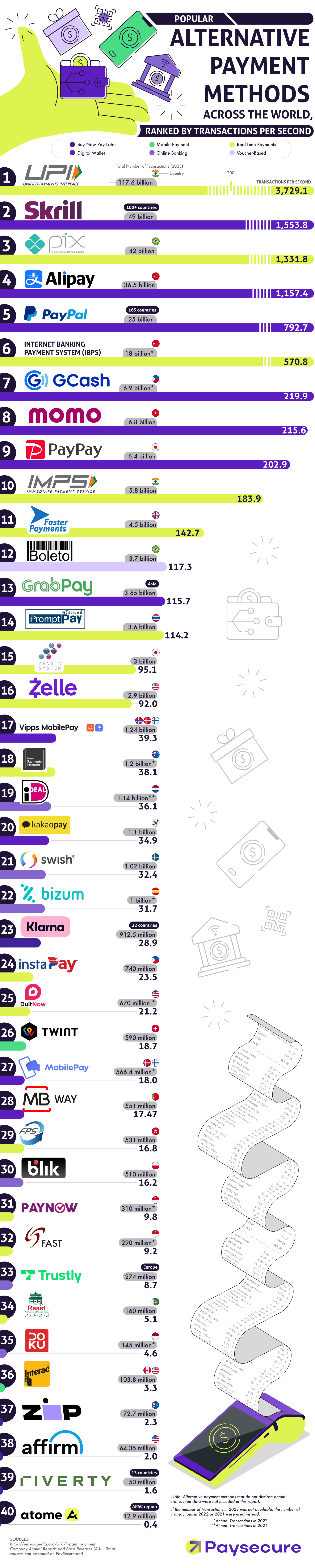

Alternative payment methods are taking the world by storm as shown in this chart from Paysecure. Alternative payment methods are transactions made through any method other than cash, credit, or debit card. Alternative payment methods offer many benefits to people worldwide. They allow people to access and use their money anywhere, any time. People in remote areas don’t need to physically visit a bank. Need to move some money at 1 AM when the banks are closed? No problem with alternative payment methods! Clearly these methods appeal to millions of people based on the transaction numbers we can see on this chart.

Click below to zoom

The team at Paysecure ranked each method based on how many transactions per second were made in 2023. Some of these numbers were astonishing! The number one alternative payment method, United Payments Interface had a walloping 3,729.1 transactions per second, which was 117.6 billion overall. The runner up, Skrill, is used in over 100 countries and had 49 billion transactions overall, while Pix, coming in at number three, is set to surpass the number of debit card users in Brazil.

The graphic indicates what country each method is used in, the type of payment method each one is, and of course, how many transactions were made using each method. This is a detailed look at how powerful alternative payment methods have become and paints a believable picture of a world where cash is left in the past, and a variety of alternatives become our banking future.