Finance Visualizations

What U.S. Cities Pay the Most in Property Taxes?

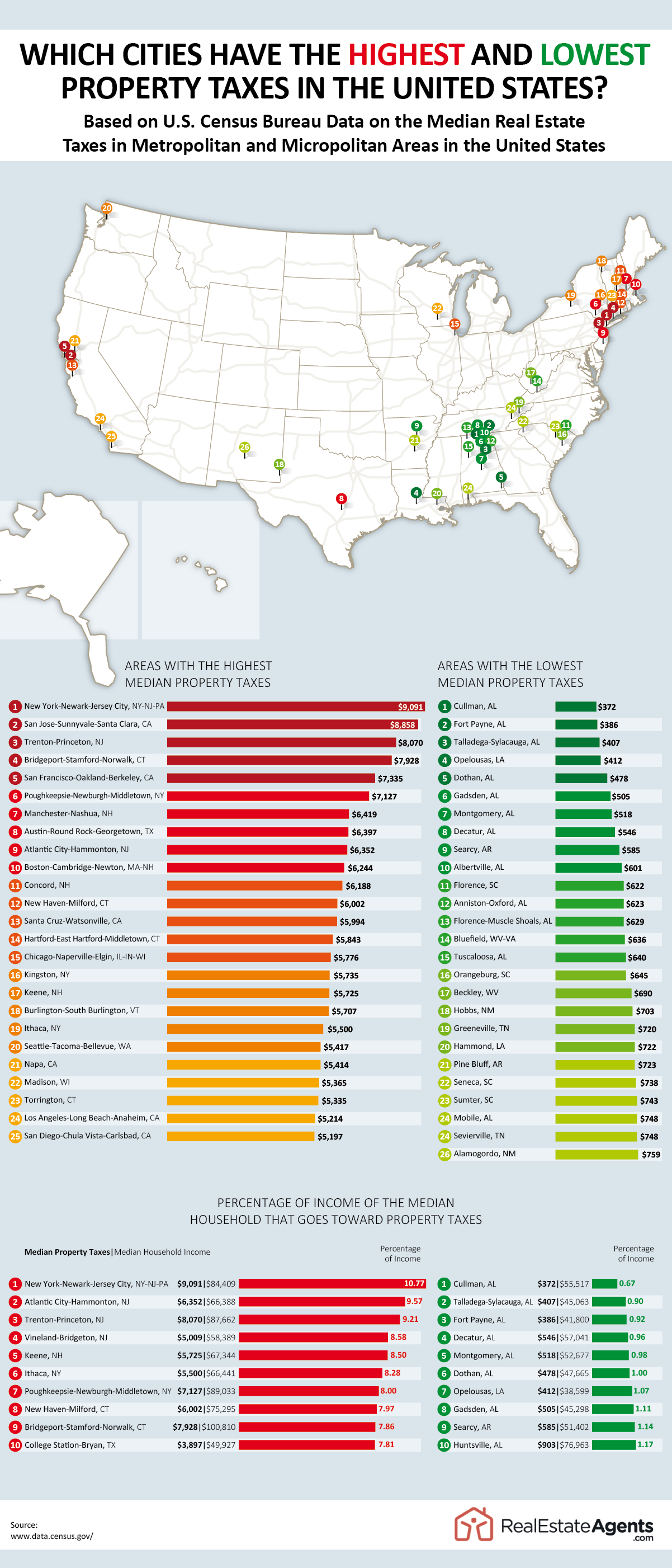

There are some cities in the United States that are known for high costs of living. San Francisco, New York City, and San Jose in particular are known for having high home prices as well. Does this translate into high property taxes?

The experts at RealEstateAgents.com looked at data from the U.S. Census Bureau to see which cities have the highest and lowest property taxes around the country. See how your property taxes compare to cities with the highest and lowest taxes in the United States!

Click below to zoom

The visualization features a U.S. pin map at the top that indicates where the cities that pay the most and least in property taxes are located. Below the map are horizontal bar charts that show the property taxes in more detail comparatively to other cities.

The area that pays the most in property taxes is the New York City metropolitan area. The median property taxes in New York City are $9,091. Home prices in New York City are very expensive as well. In February 2023, the median home sale price was $760,000.

The area with the second-highest property taxes is San Jose-Sunnyvale-Santa Clara in California, where the median property taxes are $8,858. San Jose is right in the middle of Silicon Valley, which is a haven for tech companies and employees in the tech industry. Many tech giants are based in the San Jose area including Google, Adobe, eBay, and Apple.

The city that has the lowest property taxes in the United States is Cullman, AL. The median property tax in Cullman is just $372. Cullman is located between Birmingham and Huntsville, and has a median home sale price of $240,000. In fact, property taxes are so low in the state that eight of the ten cities with the lowest property taxes in the United States are located in Alabama.