Business Visualizations

New Study Ranks College Degrees by Return on Investment

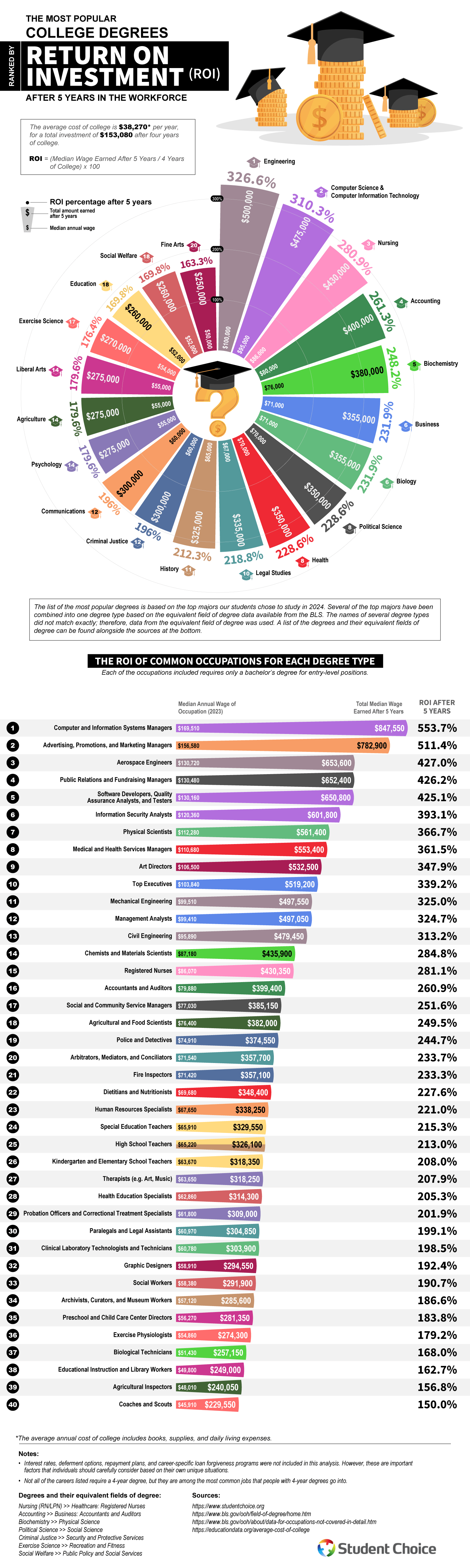

With the high cost of college tuition making headlines, choosing a college major wisely becomes a crucial financial decision. Student Choice has analyzed college majors by their return on investment (ROI) and created a graph that ranks degrees by their ROI. Passion is certainly an important factor in choosing a college major, but knowing the ROI of a major helps prospective students plan for their future and understand their future financial prospects. This graph is a powerful tool for navigating a competitive job market.

Click below to zoom.

We can see STEM dominating the results, with an Engineering degree claiming the highest ROI at 326.6%. Computer Science earns second place with a 310.3% ROI, and Nursing has a 280.9% ROI. Student Choice gathered its data from the Bureau of Labor Statistics and compared five-year earnings to the cost of four years of college tuition. Unfortunately, Liberal Arts subjects are at the bottom of the list, although they still show a positive ROI. Education majors have a 169.8% ROI and Fine Arts have the lowest ROI at 163.3%.

The team also provided data on individual professions for which these majors qualify. The highest-paid engineers appear to be Aerospace engineers, with a whopping 427% ROI on their engineering degrees. Computer and IT Systems Managers with a degree in Computer Science have an even greater ROI, at 553.7%. Although Liberal Arts degrees have the lowest ROIs, there are still significant opportunities available in specific arts-related professions. For example, marketing managers can achieve a 511.4% ROI and earn degrees in Liberal Arts, Fine Arts, or Graphic Design to qualify. Art Directors show strong earning potential within the creative sector, with a 347.9% ROI.

Some might look at this data and conclude that they can aim for some of these careers without a four-year degree. Others might research how much more they would earn in the career path with a four-year degree. Many employers are willing to pay higher salaries to employees with higher levels of education. Some sectors offer student loan forgiveness options, which can help maximize ROI. There’s a public education loan forgiveness program that forgives student loans for teachers who work in low-income school districts for a certain length of time. Borrowers may find more flexible loan solutions from credit unions compared to federal loan systems as well. Data like this is key to helping prospective students plan for the future and achieve the best ROI.

While the data is useful and well-presented, all prospective students should consider several angles when making an important decision, like which major to declare. In addition to ROI, consider your personal instincts, financial circumstances, skills, and potential career satisfaction. While financial security is important and a strong ROI will help you secure it, job satisfaction is an important aspect of future happiness. Even so, Student Choice’s work here can help all prospective students plan for their financial future.