Finance Visualizations

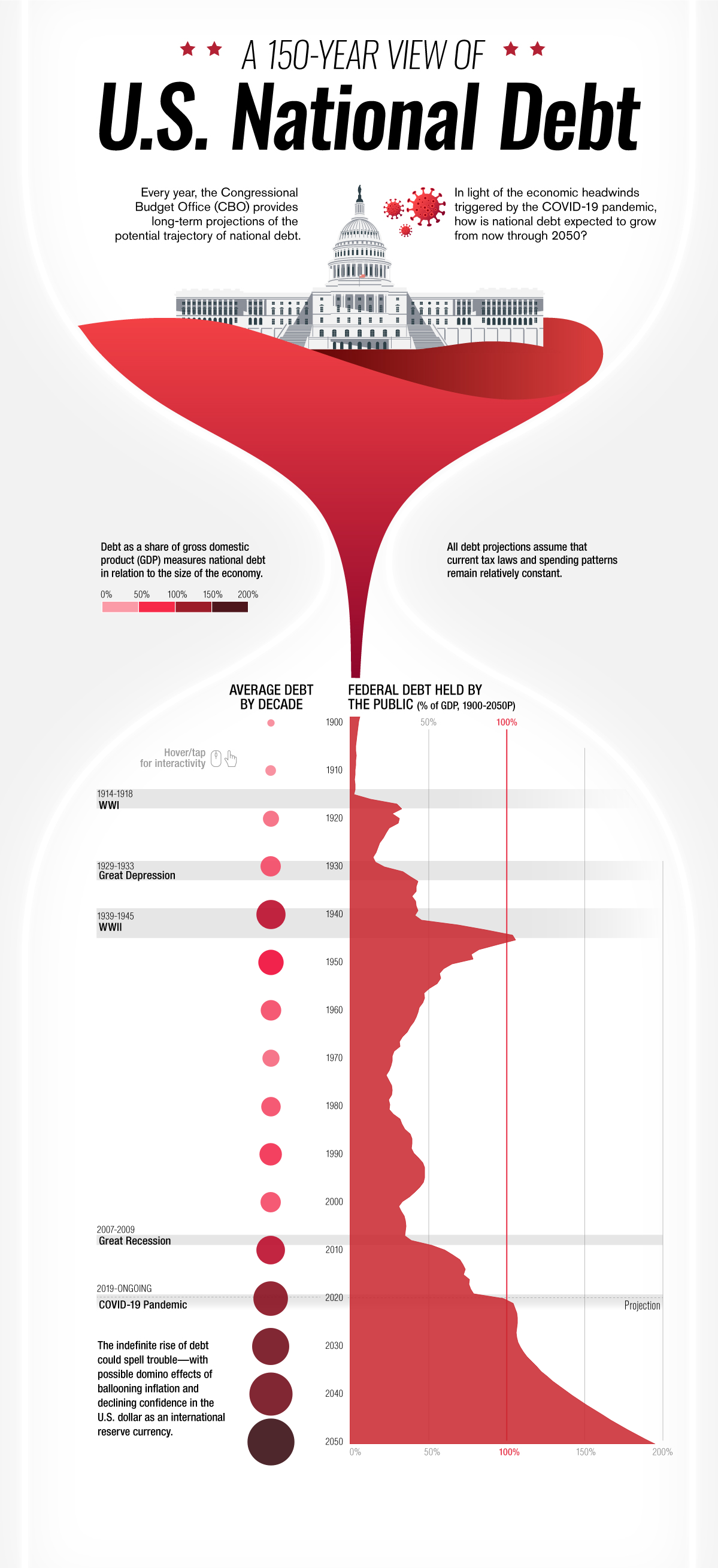

150 Years of U.S. National Debt in One Chart

Today, the national debt of the United States of America stands at an eye-watering 28 trillion dollars and rising. The CARES Act of 2020 and other stimulus bills due to COVID have added massive increases in a short period of time. To see how we got to this place to being with Visual Capitalist has this great interactive timeline of US debt over the past 150 years.

Click below to use the interactive version

Starting in the year 1900 only 4.8% of the total national debt was held by the public. After World War I in 1910 that percentage jumped to 10. In 1920 following the Great Depression that number doubled to 22.9%. Ten years later that number would be in the billions, 16 billion to be exact with President Roosevelt’s New Deal in 1930. World War II would see this number jump to 40 billion or 75.1% of the GDP. The Korean War of 1950 would add hundreds of billions to the debt clock in only ten years bringing the total in 1950 to $257 billion but bringing the GDP down to 56.8%. The next big increase would come in 1980 when president Reagan introduced his tax cuts causing the gross debt to jump to over 900 billion. Ten years later it would see another massive jump to over $3,233 billion dollars with the Gulf War. Thirty years later the COVID-19 pandemic caused the average debt held by the public to sky rocket to 105.6 percent in 2020 , over $27,748 billion dollars. By 2050 it is estimated that the percentage of debt held by the public will be almost 200 percent.

Charts

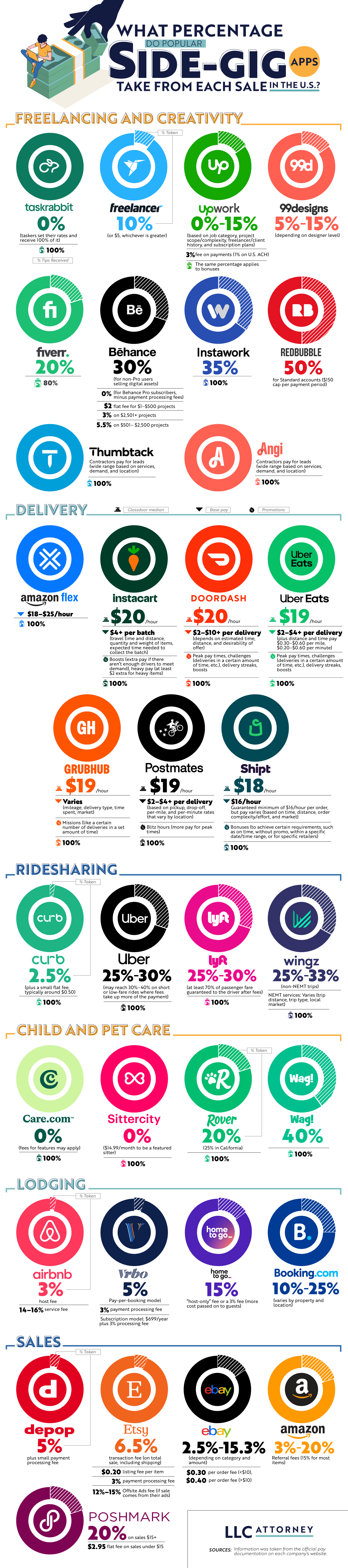

What Percentage Do Popular Side-Gig Apps Take from Each Sale in the U.S.?

An article from LLC Attorney.com offers one of the most detailed, data-rich comparisons of how much major gig and marketplace platforms extract in fees from workers’ earnings versus how much the workers keep. This article goes beyond anecdotal evidence and offers practical insights alongside raw data. Every freelancer, business owner, and part-time gig worker should understand the information presented here so they can wisely choose where to sell their products and services.

Click below to zoom.

The article’s most important message is that platforms vary widely in how much they take from earnings. These differences can have a big impact on the workers’ bottom line. Here are some examples:

Rideshare Apps: Major platforms like Lyft and Uber typically take about 25% to 30% of passenger fares, and in some cases more for low-priced trips. Drivers do get to keep 100% of tips.

Delivery Services: Delivery gig earnings are reported as base pay plus tips. Workers receive the full tip amount, but pay varies by platform and market demands.

Creative Marketplaces: Platforms like Etsy charge a 6.5% transaction fee on their total sale price, plus a payment processing fee of around 3%. There are also optional advertising fees, so the total fee is about 10%. Poshmark takes 20% of sales over $15.

Pet Care Apps: Some pet care apps, like Rover, take about 20% of earnings in fees, while Wag takes a significantly higher portion, around 40%.

The article also discussed lodging and rental platforms. Hosts on Airbnb pay a 3% host service fee, plus a guest service fee of approximately 14% to 15%. Platforms like Vrbo and Booking.com have variable fee structures that usually land between 10% and 25%, depending on the model.

What makes this article especially useful is the visual chart, which lets you quickly peruse and compare dozens of apps. If a worker juggles multiple platforms, let’s say they’re a DoorDash delivery driver, have an Etsy shop, and flip items on Poshmark, they can compare all these platforms quickly and decide which are the most profitable. This is also crucial information to help people set prices effectively.

The article places these fees in the context of the gig economy boom. Millions of people supplement their income and build independent businesses using these apps. About 16.6% of side hustlers report delivery or ride-sharing gig work as their part-time side hustle, with an online shop and freelancing close behind. Recent surveys show that 70% of Americans earn extra cash through side gigs, often via the apps listed in the chart. Even so, many users underestimate the extent of platforms’ control over visibility, fees, and pricing.

Understanding each platform’s fee structures is integral to a financial platform. These fees and the pricing workers set can have a strong influence on whether a side hustle is profitable. The information presented here is a decision-making tool that combines clear, comparative data with important context to help side hustlers succeed in their ventures.

Charts

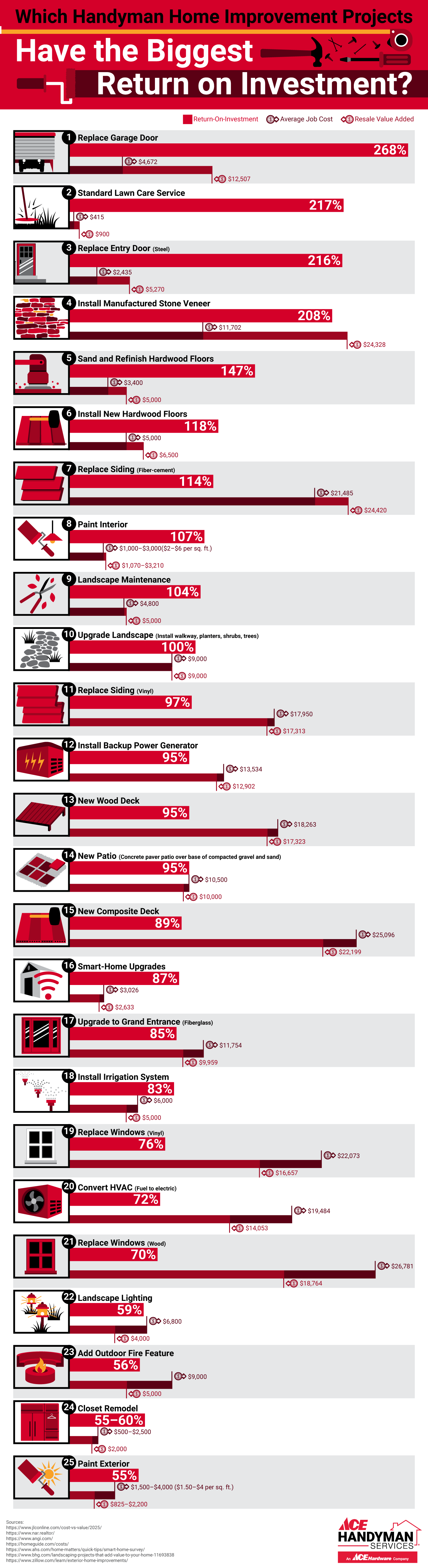

The Home Improvement Projects with the Strongest ROI

Deciding which home improvement projects are worth your time and money can yield big payoffs. Whether you think you’ll sell yourself soon or want to increase your comfort and value, you can use this new study from Ace Handyman Services to decide which projects to tackle. Their article “Which Handyman Home Improvement Projects have the Biggest ROI?” pinpoints the upgrades and repairs that will give you the greatest return on investment.

Click below to zoom.

The study focuses on cost-effective projects that offer a tangible increase in home value. These projects will improve the home’s functionality and make it look more cared for. Both qualities are appealing to potential buyers. Some of the top upgrades the team lists are garage door replacement, new entry doors, refinishing floors, fixing siding, and painting the walls. Landscaping and proper lawn care also go a long way toward increasing curb appeal. Nationwide surveys show that simple cosmetic upgrades can add over 100% of the project’s cost to the home’s value. This is particularly true if you paint in neutral or modern colors.

Experts also point to kitchen and bathroom improvements as good, modest cost investments. Replacing fixtures and cabinets can make a big difference. National data points to small-scale kitchen remodels recouping 80% to 96% of their costs, which is a much better ROI than big, expensive remodeling overhauls. We see in the team’s data that flooring and exterior upgrades also have a major impact. Well-maintained and upgraded floors are often worth more than the cost to do the project. New hardwood floors or sanding and refinishing floors add around $5,000 of resale value. A lawn care service has an enormous ROI of 217%, underscoring the massive impact of curb appeal. Upgraded landscaping can add $9,000 in value, and even simple landscape lighting can add around $4,000. You could also consider adding an outdoor fire feature, which would add $5,000 in value.

Overall, these projects had the highest ROI:

- Replacing the garage door

- Standard lawn care service

- Replace the entry door

- Install manufactured stone veneer

- Sand and refinish hardwood floors

- Install new hardwood floors

- Replace siding

- Paint interior

- Landscape maintenance

- Upgrade the landscape

The biggest message the team’s study underscores is that handyman projects can outperform big remodels and renovations in terms of increased home value. These handyman-friendly projects that the average DIYer can achieve represent a balance of cost-effectiveness, value impact, and everyday comfort enhancement. Always lean toward adding visual appeal and increasing functionality when deciding on ways to improve your home. The projects on this list will help you make a more beautiful, comfortable home without breaking your back. Whether you hire a handyman service or take on the project yourself, these projects are within your grasp and will give you a solid return on the investment.

Business Visualizations

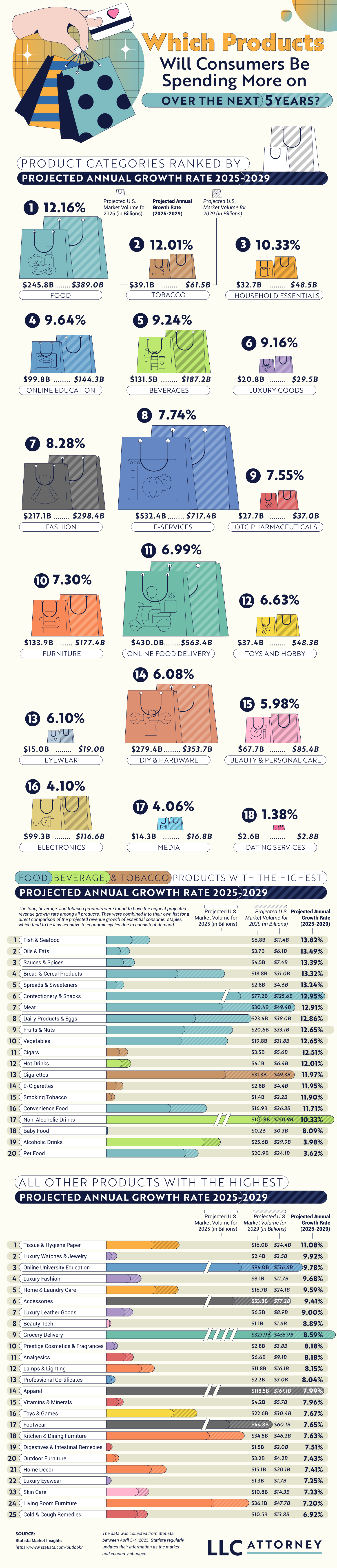

Which Products Will Consumers Spend More on in 5 Years?

The team at LLC Attorney analyzed business and economic trends to determine which products consumers will spend the most on over the next five years. Analysts invest a lot of effort into predicting spending trends to get ahead of the curve. Consumers can benefit from this data by using it to guide savings and create a budget. The team used their data to identify the individual categories that might see the highest spending and then determined how much prices may increase for products in these categories.

Click below to zoom.

Experts expect these products to see the biggest spending increase between 2025 and 2029:

- Food

- Tobacco

- Household Essentials

- Online Education

- Beverages

- Luxury Goods

- Fashion

- E-Services

- OTC Pharmaceuticals

- Furniture

Analysts predict consumers will spend $389 on food in 2029, which is a 12% increase. Food will always be a high-spending category since it’s a necessity. Inflation hit grocery prices hard, and those prices rarely go back down. Part of the reason grocery prices have increased is that busy lifestyles are driving consumers to spend more on convenience food and meal kits. At the same time, rising restaurant prices drive more people to cook at home, which means a greater spend on ingredients.

The team’s data shows specific food, beverage, and tobacco products with the largest projected spending increases:

- Fish and Seafood

- Oils and Fats

- Sauces and Spices

- Bread and Cereal Products

- Spreads and Sweeteners

- Confectionery and Snacks

- Meat

- Dairy Products and Eggs

- Fruits and Nuts

- Vegetables

Outside of those three categories, these specific products have the highest projected spending increase:

- Tissue and Hygiene Paper

- Luxury Watches and Jewelry

- Online University Education

- Luxury Fashion

- Home and Laundry Care

- Accessories

- Luxury Leather Goods

- Beauty Tech

- Grocery Delivery

- Prestige Cosmetics and Fragrances

It may be surprising to see tobacco spending increase so much. Surveys show that young adults are using more tobacco than the previous generation because of the popularity of vapes and e-cigarettes. “Vice markets” tend to rise in periods of economic strain, so the sales very well may hold firm.

The household essentials category is similar to high grocery spending. Toilet tissue is an essential item, and the COVID-19 pandemic drove up spending on cleaning products. It seems many Americans haven’t relaxed their cleaning standards since then.

A combination of current trends and expert analysis on consumer behavior leads to these spending predictions. Demographics, interests, needs, and economic stability all contribute to a population’s spending habits. Not all trends are predictable. Significant events like warfare and natural disasters can dramatically impact prices and spending habits in ways that economists may not be able to predict. While not every change can be expected, this data can still provide an accurate forecast, and consumers should pay attention to areas where prices are set to increase. Perspective business owners can also use this information to their advantage and find opportunities for areas that will be in high demand in a few years.

-

Business Visualizations1 year ago

Business Visualizations1 year agoEverything Owned by Apple

-

Business Visualizations1 year ago

Business Visualizations1 year agoAmerica’s Most Valuable Companies Ranked by Profit per Employee

-

Business Visualizations12 months ago

Business Visualizations12 months agoThe Biggest Fortune 500 Company in Every State

-

Business Visualizations9 months ago

Business Visualizations9 months agoThe Biggest Employers by Industry

-

Business Visualizations2 years ago

Business Visualizations2 years agoNew Animated Map Shows Airbnb’s Fully Booked Cities Along the 2024 Eclipse Path of Totality

-

Business Visualizations2 years ago

Business Visualizations2 years agoEverything the Luxury Giant LVMH Owns in One Chart

-

Timelines1 year ago

Timelines1 year agoTimeline Charts the Development of Communications Technology

-

Charts2 years ago

Charts2 years agoHow Many Crayola Crayon Colors Are There? A Lot.

1 Comment