Timelines

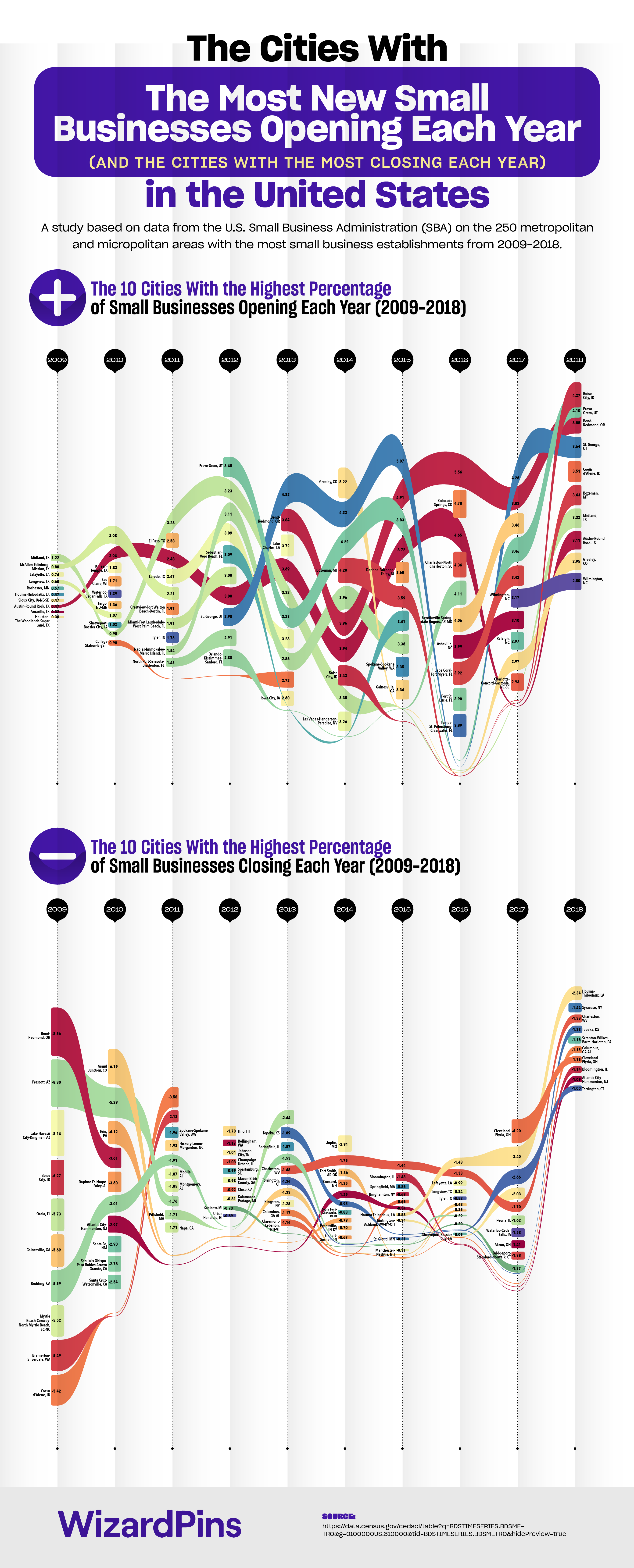

Cities that Saw the Most Small Business Openings Through the Years

-

Charts3 years ago

Charts3 years agoWhere Are the Most Bike-Friendly Cities in America?

-

Maps4 years ago

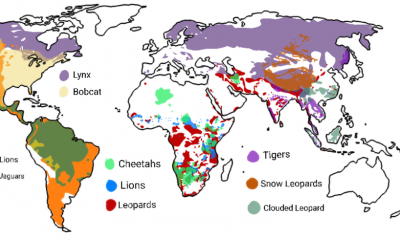

Maps4 years agoWorld Map Shows the Distribution of Big Cats Around the World

-

Misc Visuals3 years ago

Misc Visuals3 years agoWhat Brands Does Nestlé Own?

-

Timelines4 years ago

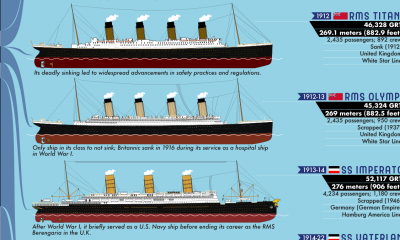

Timelines4 years agoThe Largest Passenger Ships in the World Since 1831

-

Charts4 years ago

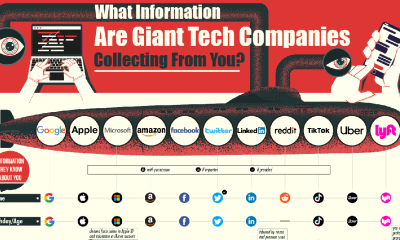

Charts4 years agoA Compilation of Information That Popular Tech Companies Collect From Their Users

-

Charts4 years ago

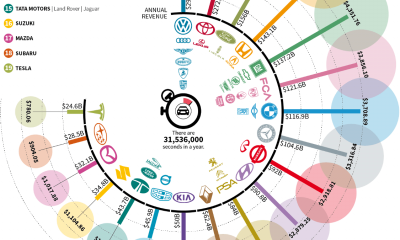

Charts4 years agoHow Much Car Manufacturers Make Every Second

-

Maps3 years ago

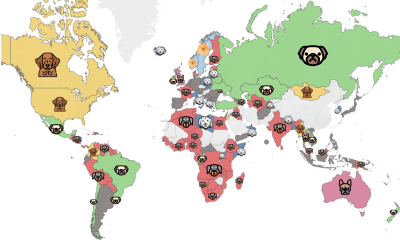

Maps3 years agoThe Most Searched Dog Breeds In Every Country Around The World

-

Charts4 years ago

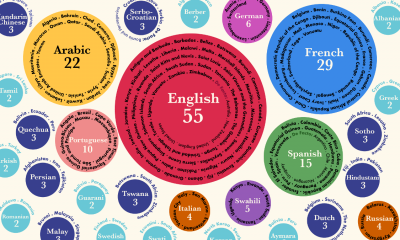

Charts4 years agoThe Official Languages Found in the Most Countries Around the World