Business Visualizations

Everything Owned by Apple

Apple Inc. has long been renowned for its innovation and cutting-edge contributions to technology. In the fifty years since its founding, Apple has gone from an obscure niche brand to one of the most well-known companies in the world. Throughout its history, Apple has acquired over 100 companies, some of which became core aspects of Apple’s brand. Since its inception, Apple has become nothing short of a cultural and economic phenomenon. This chart, which was created by the team at The Chartistry, takes a look at who founded Apple, the companies Apple owns, the many products they’ve created and sold throughout the years, and Apple’s largest stock holders.

Click below to zoom

A Brief History of Apple

Before it was the tech giant we know today, Apple had surprisingly humble roots. Apple Inc. was founded on April 1, 1976, by Steve Jobs and Steve Wozniak in Los Altos, California. As is legend at this point, the company was started in Jobs’ garage. There, the founders aimed to develop and sell personal computers, with a vision of changing the way the average person viewed home PCs. Their first product, the Apple I, laid the groundwork for future innovations, but it wasn’t until the Apple II’s release that they made a name for themselves with revolutionary color graphics.

After two decades competing with Microsoft in the home computer space, Apple became an unprecedented market leader in the portable MP3 space with the launch of the iPod in 2001. However, it was the creation of the iPhone in 2007 that truly elevated Apple to the great name we know today. Touted as one of the world’s most successful products, the iPhone’s many versions have sold billions of units, and allowed Apple Inc. to become the first company valued at one trillion dollars in 2018. Just two years later, it doubled that figure. Since the historic iPhone launch, Apple has released many new products to various success and increased their reach around the world through their profitable innovations and various company acquisitions.

What Companies Does Apple Own?

Since its beginnings as a home computer manufacturer, Apple has dramatically changed its operations to include a variety of products and services. Apple has acquired approximately 125 companies over its lifetime, many of which are still in operation today. Many of these were smaller companies that Apple incorporated into their products, such as FaceID being created from PrimeSense. PrimeSence was acquired by Apple in 2013.

In 2022, Apple’s CEO Tim Cook claimed Apple had acquired more than 100 companies over the preceding six years alone. Apple subsidiaries are only expected to increase as the brand continues its upward trajectory, though it’s important to note that their acquisition rate has slowed recently with the cooling of the investment in the tech sector since the start of the COVID-19 pandemic.

So far, Apple’s largest acquisition has been Beats at $3 Billion, followed by Intel at $1 Billion.

Apple’s Product Range

Currently, Apple Inc. has five main products: Macs, iPhones, iPads, accessories and services. Over the years, the company has shifted their primary focus from the home computer space in favor of the mobile device market, which has proven to be more lucrative. Though Apple has rarely been the first to introduce a product of its kind to the market, they have a history of redefining the market with their innovations to the field.

Mac

Personal computers have been the foundation of Apple’s product lineup since the beginning with Mac taking the mantle in 1979. Though they still compete with Microsoft in this space, Apple’s M1 and M2 chips have set new standards in the computing industry.

iPhone

In the era of flip phones and BlackBerry, the iPhone revolutionized the mobile phone industry and made smart phones the new global standard. Since then, each new generation of iPhone has introduced significant advancements in camera technology, processing power, and software features, solidifying its status as a market leader.

Apple Watch

The Apple Watch was introduced in 2014 and has quickly become the world’s most popular smartwatch. Combining fitness tracking, health monitoring, and communication features in a sleek, customizable design, it’s carved out a space as a health device as well as a smartphone accessory.

iCloud

iCloud, launched in 2011, is Apple’s cloud storage and computing service, which allows users to store data such as photos, documents, and music, and sync them across all their Apple devices. iCloud has become an integral part of the Apple ecosystem, ensuring seamless data management and providing services like iCloud Drive, iCloud Photos, and iCloud Backup.

Apple Pay

Apple Pay, introduced in 2014, is Apple’s mobile payment and digital wallet service. Thanks to its secure, contactless payments, integrated with the iPhone, Apple Watch, and other Apple devices, it has become a popular choice for digital transactions worldwide.

Who Owns Apple?

Apple’s stock market performance has been nothing short of remarkable. Since it first hit $1 trillion with the launch of the iPod, Apple’s continuous releases, innovations, and success have ranked it among the most valuable companies in the world. The company’s commitment to returning value to shareholders through dividends and stock buybacks further enhances its attractiveness as an investment.

As of January 2024, The Vanguard Group holds the largest percentage of Apple shares at 8.54%. Arthur Levinson, Chairman of the Board, takes the prize for individual shareholders, holding more than 4.5 million shares.

Apple Inc. is a cultural and financial juggernaut that continues to shape the modern world through its creative and strategic vision. From its humble beginnings in a garage to its status as a trillion-dollar company, Apple’s journey is a testament to its ability to adapt and lead. For investors and technology enthusiasts alike, Apple is a fascinating case study in the power of innovation and business strategy. Check out our business visualizations for more on topics like Apple, or take a look at all of the data visualizations on The Chartistry.

List of Companies Apple Owns

- Beats Electronics

- Intel Smartphone Modem Business (include S.M.D. under Intel logo)

- Dialog Semiconductor

- Anobit Technologies

- Texture

- Shazam

- NeXT

- PrimeSense

- AuthenTec

- PA Semi

- Beddit

- Braeburn Capital

- Claris

- Siri

- Mobeewave

Apple Products

| Apple Product | Percent of Company’s Revenue, end of 2023 |

| Mac | 8.00% |

| iPhone | 50%+ |

| iPad | 7.00% |

| Wearables, Home and Accessories | 10.00% |

| Airpods | |

| Apple Watch | |

| Apple TV | |

| Home Pod | |

| Vision Pro | |

| Beats Headphones | |

| Services: | 22.00% |

| App Store (advertising space) | |

| Apple News app (advertising space) | |

| AppleCare+ | |

| iCloud+ | |

| Apple Card | |

| Apple Pay | |

| Apple Books | |

| Apple Fitness+ | |

| Apple Music | |

| Apple News+ | |

| Apple TV+ | |

| Apple Arcade | |

| Apple Podcasts | |

| iTunes Store |

Who Owns Apple?

| # | The 10 Largest Stockholders | Percent of Apple Shares |

| 1 | The Vanguard Group | 8.54% |

| 2 | BlackRock | 6.75% |

| 3 | Berkshire Hathaway | 5.86% |

| 4 | State Street Corporation | 3.80% |

| 5 | Geode Capital Management | 1.95% |

| 6 | Fidelity Investments | 1.94% |

| 7 | Morgan Stanley | 1.41% |

| 8 | T. Rowe Price | 1.37% |

| 9 | Norges Bank | 1.14% |

| 10 | Northern Trust | 1.05% |

Business Visualizations

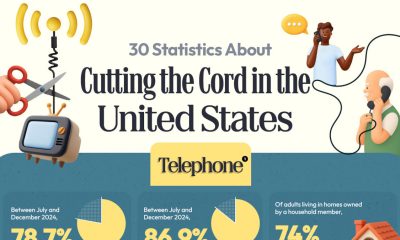

Most Mattress Brands Are Owned by a Handful of Companies

When you visit a mattress store or browse through mattress options online, there are a lot of choices that make us feel like we’re choosing from dozens of options from a wide variety of companies. But this choice is an illusion, as a handful of corporations actually own these brands and control large portions of the mattress and bedding industries. The team at NapLab breaks down ownership of the most recognizable mattress companies. Their work shows us that brand diversity is often a mask for a limited corporate structure.

Click below to zoom.

One of the biggest shareholders of the mattress industry is Somnigroup International. They used be called Tempur Sealy International, a name you probably recognize. What you might not realize is that this company owns brands like Tempur-Pedic, Sealy, Stearns & Foster, Sherwood Bedding, and Sleepy’s. They also own the entire extensive Mattress Firm retail store network. This makes Somnigroup International a powerful driving force in mattress sales and distribution.

Another big player in the industry is Serta Simmons Bedding LLC (SSB). They own classic brand names like Simmons, Serta, Beautyrest, and Tuft & Needle. SSB has had its share of financial challenges, including filing for Chapter 11 bankruptcy in 2023, but it still continues to own a significant share of the American mattress market.

Not all these owners are giant manufacturers. Ashley Global Retail is best known for furniture, but it entered the mattress market when it acquired the Resident Home family of brands, which includes Nectar, Awara, Siena, DreamCloud, and Ashley Sleep. These options encompass both luxury and budget-friendly mattress brands.

3Z Brands is a key player in the direct-to-consumer mattress sales space. They own the brands Helix Sleep, Bear, Brooklyn Bedding, Leesa, and Nolah. These brands represent the share of shoppers who prefer buying a mattress online rather than dealing with retailers and sales representatives.

Saatva Inc. used to focus solely on selling luxury mattresses online, but in 2023, it merged with Bedding Industries of America. The merger added other brands to their roster, including Eclipse, Millbrook, Ernest Hemingway, and Eastman House, in addition to Saatva’s name brand of products.

We also see some international companies represented here. GoodMorning.com, formerly known as Novosbed, is a Canadian company that primarily sells to the U.S. market, encompassing the brands Octave, Juno, Douglas, and Logan & Cove.

The Flex Bedding Group is Spanish-owned and sells luxury and niche products to Americans, including the high-end brands Marshall Mattress, E.S. Kluft & Co., Kluft, Aireloom, and Vispring.

Understanding which companies own these mattress brands helps consumers make informed choices. It also helps us understand that brands might appear vastly different, but in reality, they’re under the same corporate umbrella, which influences everything from pricing to marketing to manufacturing.

This brand consolidation isn’t any different from many other industries, like beer and skincare, but it does raise consumer concerns about true choice and industry competition.

Business Visualizations

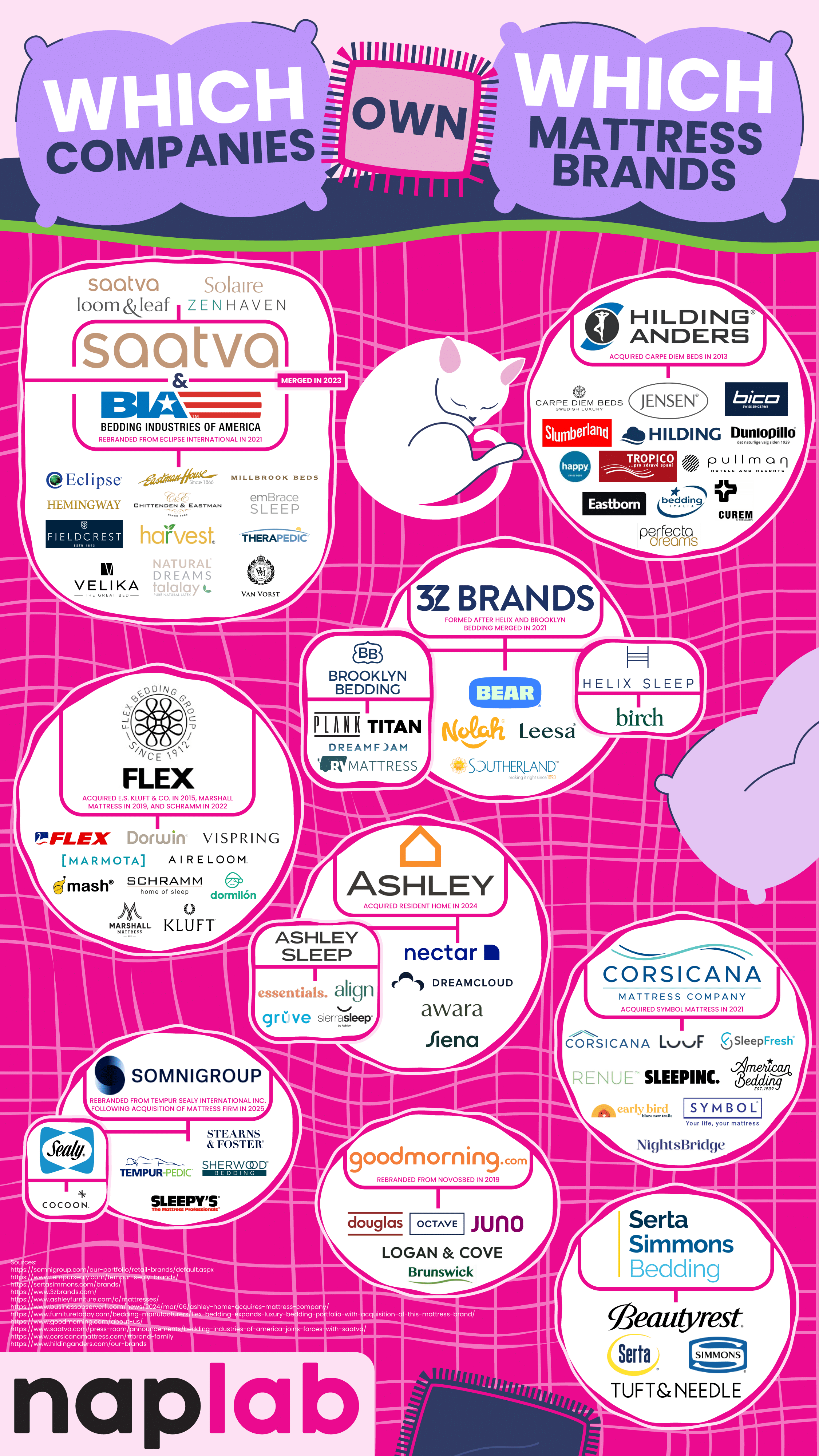

Ranking States by Workplace Cleanliness

The team at Stratus Building Solutions reveals which states have the cleanest and dirtiest workplaces in a new study. Cleanliness is often an overlooked but powerful influence on workers’ health, happiness, and productivity. People who work in an office spend many hours there and have a right to a clean, safe space to work, whether that’s at their desk, in the breakroom, or in the bathroom. The team’s study reveals that cleanliness depends on more than company policy and culture. It’s impacted by resources and state laws. While some states mandate rules that boost workers’ health and safety, other locations lack such protections and put workers at risk.

Click below to zoom.

The team created a scoring system based on some key criteria. First was the number of OSHA violations. OSHA is the Occupational Safety and Health Administration, which sets federal workplace safety standards, including sanitation standards. A state with a high number of OSHA sanitation violations is a clear sign of dirty workplaces. These violations could include unclean restrooms, inadequate waste disposal, or the presence of mold and bacteria. The team also examined the number of janitors per capita, population density, air pollution, and sick leave laws in each state.

The team found that these states were the cleanest with the highest scores:

- Nebraska

- Colorado

- North Dakota

- South Dakota

- Washington

- Missouri

- Montana

- Idaho

- Michigan

- New Mexico

The top scorers had low rates of OSHA violations, clean air, and high janitor-to-population ratios. State laws mandating sick leave also play a major role, as workers are more likely to stay home rather than bring germs to work.

These were the states that struggled the most with these standards:

- Tennessee

- North Carolina

- Mississippi

- Virginia

- Connecticut

- Oregon

- Nevada

- Rhode Island

- Alabama

- New Jersey

- Pennsylvania

Many of these states are on the dirty end of the spectrum, lacking paid sick leave. Tennessee, Mississippi, and North Carolina do not have laws on paid sick leave, which, when combined with the absence of handwashing stations and disinfecting services, makes the workplace a petri dish for germs. We also see heavily populated states like New York and New Jersey on the low end of the spectrum because more people means a greater challenge to clean up waste and keep germs at bay. High populations also mean bigger cities and more air pollution. We do see, however, that lower population density doesn’t necessarily mean cleaner workplaces, as Vermont was near the bottom of the list and has a small population.

Clean workplaces are healthy workplaces. Dust, germs, and air pollution lead to gastrointestinal and respiratory problems among workers. Simple precautions like regularly disinfecting surfaces, installing handwashing stations, and removing dust can boost the cleanliness of the office and the health of workers. Healthy workers mean better productivity and greater safety for all. Not only will a clean space improve worker experience, but OSHA violations can be very costly. The team’s study provides fascinating insights into what affects workplace cleanliness.

Business Visualizations

New Study Examines Language Used to Let Employees Go

Letting an employee go is an unpleasant experience for everyone involved, but language has the power to guide the emotions surrounding an interaction. While the right words won’t erase the bad side of being let go, they can help the employee in question understand why the situation is happening and make them feel seen and heard. Preply leaned into the language aspects in these situations with a study examining the most common phrases and words used when letting an employee go and how employers and employees felt about the situation.

Click below to zoom.

Overall, the team found that these were the most common phrases used:

- Letting you go

- Effective immediately

- Terminating your employment

- This isn’t working out

- No longer require services

- Parting ways

- Ending your employment

- No longer needed

- Relieved of duties

- Ending our working relationship

Managers and employees seem to agree that lack of empathy and responsibility were the most common complaints about the process. One in six managers say they regret the words they chose when firing someone, and 92% feel they need more training on how to handle such situations. Employees wanted their managers to focus on clarity, compassion, empathy, and honesty when firing an employee.

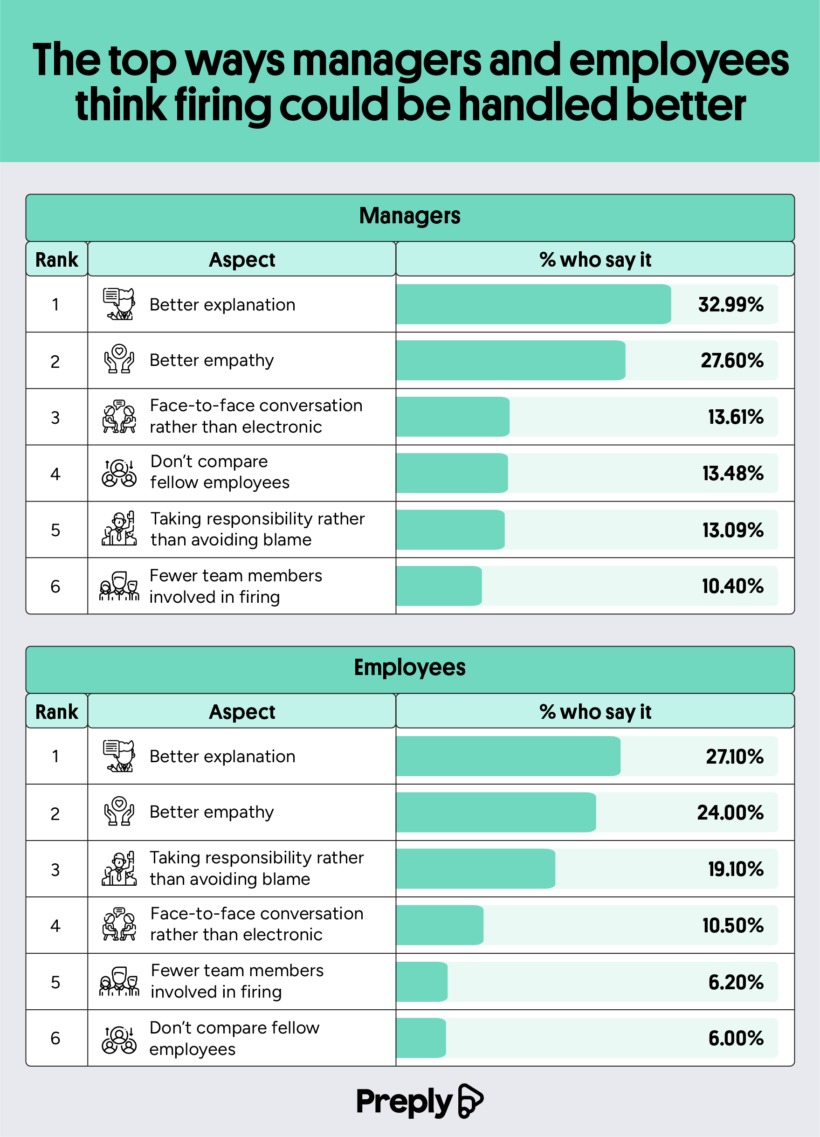

The team studied changes that both managers and employees would like to see in the firing process.

These are the six things employees want to see improved:

- Better explanation

- Better empathy

- Taking responsibility rather than avoiding blame

- Face-to-face conversation rather than electronic

- Fewer team members involved in the firing

- Don’t compare fellow employees

Here’s how that compares to changes managers would like to make to the process:

- Better explanation

- Better empathy

- Face-to-face conversation rather than electronic

- Don’t compare fellow employees

- Taking responsibility rather than avoiding blame

- Fewer team members involved in firing

These are similar answers, but we can see that the two groups ranked their importance differently. Overall, 92% of Americans think managers could benefit from some language training when it comes to firing someone. Empathy and honesty were high on the list of employee wishes, indicating that understanding can help give them closure on the job, and empathy softens the blow. Not many managers would prefer a face-to-face meeting. Only 1 in 6 prefer this to virtual meetings, which seem to be the most common option.

Only 55% of managers have received training on how to fire someone, and with many of them regretting their language choices, it seems that many managers would benefit from some education in business language and communication. Notice that many of the top phrases are more professional ways to say “fired,” like “letting you go,” “terminating,” and “no longer require.”

When managing a team, empathy and clear language are crucial. These skills can help managers excel at many tasks beyond having to let an employee go. But when a situation like firing someone is emotionally charged, the language used becomes more important than ever. Hopefully, the team’s study can help managers reflect on how they go about the process.

-

Business Visualizations1 year ago

Business Visualizations1 year agoAmerica’s Most Valuable Companies Ranked by Profit per Employee

-

Business Visualizations12 months ago

Business Visualizations12 months agoThe Biggest Fortune 500 Company in Every State

-

Business Visualizations9 months ago

Business Visualizations9 months agoThe Biggest Employers by Industry

-

Business Visualizations2 years ago

Business Visualizations2 years agoNew Animated Map Shows Airbnb’s Fully Booked Cities Along the 2024 Eclipse Path of Totality

-

Business Visualizations2 years ago

Business Visualizations2 years agoEverything the Luxury Giant LVMH Owns in One Chart

-

Timelines1 year ago

Timelines1 year agoTimeline Charts the Development of Communications Technology

-

Charts2 years ago

Charts2 years agoHow Many Crayola Crayon Colors Are There? A Lot.

-

Business Visualizations5 months ago

Business Visualizations5 months agoThe Largest Companies in America That Are Still Run by the Person Who Founded Them