Finance Visualizations

How Big of a House Can You Get for $1M Around the United States?

A million dollars is a million dollars, right? Well, it turns out that a million dollars can go a lot further in some U.S. cities than it can in others. This new 3D bar graph map visualization from RoofClaim.com reveals just how far (or not so far) your dollar can go when it comes to buying a house. The results are fascinating:

Click below to zoom

In Detroit, Michigan, you can buy a 22,000-plus square foot mega-mansion for $1 million. That’s nearly half the size of a football field. And in Memphis, Tennessee, you can get a similarly-sized 17,847 sq ft home for the same amount of money. Although, the local market in Memphis seems to be turning around this year.

On the other end of the spectrum, the real estate market in San Francisco is a whole different story. With one million dollars you’d only be able to get about 909 square feet. In Detroit, a home of that size would only run you about $40,905. But, just because housing prices are low, doesn’t mean it’s a good buy. Be sure to do your own research.

So why is it that real estate markets in the same country can be priced so wildly different? Well, that’s a complicated answer. A lot of factors come into play when it comes to real estate value in a specific city. Some include housing availability, crime rate, the job market, waterfront or other favorable views, and more. In San Francisco, it’s emerging that housing prices are so high that even highly paid tech workers can’t afford to live there.

How does your local city or town stack up? Let us know in the comments!

Charts

The Home Improvement Projects with the Strongest ROI

Deciding which home improvement projects are worth your time and money can yield big payoffs. Whether you think you’ll sell yourself soon or want to increase your comfort and value, you can use this new study from Ace Handyman Services to decide which projects to tackle. Their article “Which Handyman Home Improvement Projects have the Biggest ROI?” pinpoints the upgrades and repairs that will give you the greatest return on investment.

Click below to zoom.

The study focuses on cost-effective projects that offer a tangible increase in home value. These projects will improve the home’s functionality and make it look more cared for. Both qualities are appealing to potential buyers. Some of the top upgrades the team lists are garage door replacement, new entry doors, refinishing floors, fixing siding, and painting the walls. Landscaping and proper lawn care also go a long way toward increasing curb appeal. Nationwide surveys show that simple cosmetic upgrades can add over 100% of the project’s cost to the home’s value. This is particularly true if you paint in neutral or modern colors.

Experts also point to kitchen and bathroom improvements as good, modest cost investments. Replacing fixtures and cabinets can make a big difference. National data points to small-scale kitchen remodels recouping 80% to 96% of their costs, which is a much better ROI than big, expensive remodeling overhauls. We see in the team’s data that flooring and exterior upgrades also have a major impact. Well-maintained and upgraded floors are often worth more than the cost to do the project. New hardwood floors or sanding and refinishing floors add around $5,000 of resale value. A lawn care service has an enormous ROI of 217%, underscoring the massive impact of curb appeal. Upgraded landscaping can add $9,000 in value, and even simple landscape lighting can add around $4,000. You could also consider adding an outdoor fire feature, which would add $5,000 in value.

Overall, these projects had the highest ROI:

- Replacing the garage door

- Standard lawn care service

- Replace the entry door

- Install manufactured stone veneer

- Sand and refinish hardwood floors

- Install new hardwood floors

- Replace siding

- Paint interior

- Landscape maintenance

- Upgrade the landscape

The biggest message the team’s study underscores is that handyman projects can outperform big remodels and renovations in terms of increased home value. These handyman-friendly projects that the average DIYer can achieve represent a balance of cost-effectiveness, value impact, and everyday comfort enhancement. Always lean toward adding visual appeal and increasing functionality when deciding on ways to improve your home. The projects on this list will help you make a more beautiful, comfortable home without breaking your back. Whether you hire a handyman service or take on the project yourself, these projects are within your grasp and will give you a solid return on the investment.

Business Visualizations

Which Products Will Consumers Spend More on in 5 Years?

The team at LLC Attorney analyzed business and economic trends to determine which products consumers will spend the most on over the next five years. Analysts invest a lot of effort into predicting spending trends to get ahead of the curve. Consumers can benefit from this data by using it to guide savings and create a budget. The team used their data to identify the individual categories that might see the highest spending and then determined how much prices may increase for products in these categories.

Click below to zoom.

Experts expect these products to see the biggest spending increase between 2025 and 2029:

- Food

- Tobacco

- Household Essentials

- Online Education

- Beverages

- Luxury Goods

- Fashion

- E-Services

- OTC Pharmaceuticals

- Furniture

Analysts predict consumers will spend $389 on food in 2029, which is a 12% increase. Food will always be a high-spending category since it’s a necessity. Inflation hit grocery prices hard, and those prices rarely go back down. Part of the reason grocery prices have increased is that busy lifestyles are driving consumers to spend more on convenience food and meal kits. At the same time, rising restaurant prices drive more people to cook at home, which means a greater spend on ingredients.

The team’s data shows specific food, beverage, and tobacco products with the largest projected spending increases:

- Fish and Seafood

- Oils and Fats

- Sauces and Spices

- Bread and Cereal Products

- Spreads and Sweeteners

- Confectionery and Snacks

- Meat

- Dairy Products and Eggs

- Fruits and Nuts

- Vegetables

Outside of those three categories, these specific products have the highest projected spending increase:

- Tissue and Hygiene Paper

- Luxury Watches and Jewelry

- Online University Education

- Luxury Fashion

- Home and Laundry Care

- Accessories

- Luxury Leather Goods

- Beauty Tech

- Grocery Delivery

- Prestige Cosmetics and Fragrances

It may be surprising to see tobacco spending increase so much. Surveys show that young adults are using more tobacco than the previous generation because of the popularity of vapes and e-cigarettes. “Vice markets” tend to rise in periods of economic strain, so the sales very well may hold firm.

The household essentials category is similar to high grocery spending. Toilet tissue is an essential item, and the COVID-19 pandemic drove up spending on cleaning products. It seems many Americans haven’t relaxed their cleaning standards since then.

A combination of current trends and expert analysis on consumer behavior leads to these spending predictions. Demographics, interests, needs, and economic stability all contribute to a population’s spending habits. Not all trends are predictable. Significant events like warfare and natural disasters can dramatically impact prices and spending habits in ways that economists may not be able to predict. While not every change can be expected, this data can still provide an accurate forecast, and consumers should pay attention to areas where prices are set to increase. Perspective business owners can also use this information to their advantage and find opportunities for areas that will be in high demand in a few years.

Business Visualizations

The Largest Companies in America That Are Still Run by the Person Who Founded Them

In the corporate world, leadership changes are practically expected. CEOs come and go, boards shuffle seats, and strategies pivot with the seasons. For most large corporations, the founding vision eventually gives way to the influence of successors, but every once in a while, a company manages to scale the peaks of the Fortune 1000 while still being led by the very person who dreamed it up in the first place.

Going from running a business out of your garage to managing a multi-billion-dollar operation requires an impressive mix of genius, grit, and endurance that most would struggle to sustain across decades of board meetings, bold bets, and bottom-line pressure.

So, what does it take to build a business worth billions and still be the one calling the shots? To find out, our team at The Chartistry has pulled together a graphic that maps out the largest companies in the U.S. that are still being run by the same people who started them.

Click below to zoom.

Tech Giants Still Calling the Shots

The tech industry can be a volatile market, especially when billions of dollars are at stake every year, making founder-CEOs in this space a rare species. Mark Zuckerberg, founder and CEO of Facebook (now Meta), is a headline example. From the scrappy days of coding in his Harvard dorm to overseeing Meta’s $134.9 billion revenue machine, he hasn’t let go of the reins. His company now ranks 30th on the Fortune 1000 list, but it continues to operate under the umbrella of Zuckerberg’s vision.

Jensen Huang of NVIDIA is another powerhouse. He co-founded the company in 1993 and continues to lead it as CEO and President. NVIDIA is now a central player in the AI boom, raking in over $60.9 billion in 2024. The company landed at #65 on the Fortune list, and much of that momentum can be traced back to Huang’s technical savvy and leadership style.

Another founder-CEO of a big tech company is Michael Dell. After founding Dell Technologies in 1984, Dell stepped away briefly before returning to steer the company through its privatization and subsequent return to public markets. With $88.43 billion in revenue, it holds spot #48 on the list.

Long-Hauler Founders of the Biggest U.S. Companies

Wall Street can be brutal, yet some of the longest-tenured company founders make the ranks in this industry. Richard Fairbank has run Capital One since 1987, long before online banking was the norm. Under his leadership, the company pulled in $49.48 billion last year.

Larry Fink’s story is equally impressive. He co-founded BlackRock in 1988 and helped turn it into the world’s largest asset manager. It now generates $17.86 billion annually.

Then there’s Mark Millett, who co-founded Steel Dynamics in 1993. It might not make splashy headlines like tech and finance, but this steel manufacturer generated $18.8 billion last year, proving that innovation can lead to immense success in any space.

Is Elon Musk Actually the Founder of Tesla?

Elon Musk is arguably the most high-profile figure on the list, but his relationship with Tesla’s origins is less straightforward than the others on our list. Tesla was actually founded by Martin Eberhard and Marc Tarpenning in 2003. Musk joined shortly after as an investor and took a more active role over time. It wasn’t until a legal settlement in 2009 that Musk was “officially” determined to be a co-founder, along with four others. Today, he serves as the CEO and public face of Tesla, a company that posted $96.77 billion in revenue in 2024.

Why Are They Still Here?

While circumstances vary and some CEO-Founders stick around long after what’s best for the company, research seems to support that many of them remain the right person for the job. A Harvard Business Review study found that companies led by their founders outperformed others in market valuation by 10% over the long term. Especially in the early days when the potential rewards are higher, founders tend to prioritize innovation, take bigger strategic bets, and maintain a stronger emotional commitment to the company’s mission.

Additionally, founder-CEOs often make faster decisions, have deeper customer intuition, and are more adaptable when navigating new markets. These traits help fuel long-term growth and can serve as a stabilizing force in times of disruption. That said, success depends on their ability to scale alongside the business. The most effective founders seem to grow their leadership style as the company matures, surrounding themselves with experienced teams while staying grounded in the original vision.

In many cases, large companies will also adopt dual-class stock structures, which help founders maintain some control even as ownership becomes more distributed.

Out of the 1,000 biggest companies in America, only 59 are still run by their founders. Amounting to less than 6 percent, it’s both inspiring and daunting how successful many of their companies have become.

Along with shaping industries and building legacies, they’re keeping their original visions alive in a world that often trades the leadership of innovative founders for business-savvy executives. Their stories serve as a reminder that leadership is about commitment and conviction as much as it is about keeping a business running.

At The Chartistry, we know that there’s a great story behind every dataset. Explore more trends in executive leadership, company growth, and market innovation in America’s largest companies on our Business Visualization page. Or, if you’re looking for more inspiring stories of success, check out our Finance Visualizations.

Founders of Major Corporations Still Serving as CEO

The list of America’s largest companies that are still run by the person who founded them is based on data from Fortune’s list of the 1,000 biggest companies in the United States. Just 59 of the 1,000 biggest U.S. companies are still run by the person who founded them. The founder must be the current Chief Executive Officer (CEO) of the company, as of June 2025, to be included.

| Rank | Company | Forbes 1000 Rank (as of July 2024) |

Revenue in Billions (as of July 2024) |

CEO Name | Year Founded | Title (as of June 2025) |

| 1 | Meta Platforms | 30 | $134.90 | Mark Zuckerberg | 2004 | Co-Founder, CEO, Chairman |

| 2 | Tesla | 40 | $96.77 | Elon Musk | 2003 (Musk was designated as one of five co-founders in 2009 via a settlement.) |

Co-Founder, CEO |

| 3 | Dell Technologies | 48 | $88.43 | Michael Dell | 1984 | Founder, CEO, Chairman |

| 4 | NVIDIA | 65 | $60.92 | Jensen Huang | 1993 | Co-Founder, CEO, President |

| 5 | Capital One Financial | 91 | $49.48 | Richard Fairbank | 1987 | Co-Founder, CEO, Chairman |

| 6 | Salesforce | 123 | $34.86 | Marc Benioff | 1999 | Co-Founder, CEO, Chairman |

| 7 | Apollo Global Management | 136 | $32.64 | Marc Rowan | 1990 | Co-Founder, CEO, Chairman |

| 8 | Coupang | 168 | $24.38 | Bom Kim | 2010 | Founder, CEO, Chairman |

| 9 | Block | 186 | $21.92 | Jack Dorsey | 2009 | Co-Founder, CEO, Chairman |

| 10 | Steel Dynamics | 221 | $18.80 | Mark Millett | 1993 | Co-Founder, CEO, Chairman |

| 11 | BlackRock | 231 | $17.86 | Larry Fink | 1988 | Co-Founder, CEO, Chairman |

| 12 | Regeneron Pharmaceuticals | 311 | $13.12 | Leonard Schleifer | 1988 | Co-Founder, CEO, President, Co-Chairman |

| 13 | Wayfair | 346 | $12.00 | Niraj Shah | 2002 | Co-Founder, CEO, Co-Chairman |

| 14 | Carvana | 377 | $10.77 | Ernest Garcia III | 2012 | Co-Founder, CEO, President, Chairman |

| 15 | Airbnb | 396 | $9.92 | Brian Chesky | 2008 | Co-Founder, CEO |

| 16 | Intercontinental Exchange | 397 | $9.90 | Jeffrey Sprecher | 2000 | Founder, CEO, Chairman |

| 17 | Sanmina | 433 | $8.94 | Jure Sola | 1980 | Co-Founder, CEO, Chairman |

| 18 | DoorDash | 443 | $8.64 | Tony Xu | 2013 | Co-Founder, CEO |

| 19 | Prologis | 463 | $8.02 | Hamid Moghadam | 1983 | Co-Founder, CEO, Chairman |

| 20 | Blackstone | 464 | $8.02 | Stephen Schwarzman | 1985 | Co-Founder, CEO, Chairman |

| 21 | Skechers U.S.A. | 465 | $8.00 | Robert Greenberg | 1992 | Founder, CEO, Chairman |

| 22 | Super Micro Computer | 498 | $7.12 | Charles Liang | 1993 | Co-Founder, CEO, Chairman, President |

| 23 | Insperity | 541 | $6.49 | Paul Sarvadi | 1986 | Co-Founder, CEO, Chairman |

| 24 | Under Armour | 577 | $5.90 | Kevin Plank | 1995 | Founder, CEO, Chairman, President |

| 25 | SS&C Technologies Holdings | 600 | $5.50 | William Stone | 1986 | Founder, CEO, Chairman |

| 26 | Fortinet | 622 | $5.31 | Ken Xie | 2000 | Founder, CEO, Chairman |

| 27 | Urban Outfitters | 635 | $5.15 | Richard Hayne | 1970 | Co-Founder, CEO, Chairman |

| 28 | Ares Management | 644 | $4.99 | Michael Arougheti | 1997 | Co-Founder, CEO, Director |

| 29 | Nexstar Media Group | 648 | $4.93 | Perry Sook | 1996 | Founder, CEO, Chairman |

| 30 | Compass | 654 | $4.89 | Robert Reffkin | 2012 | Co-Founder, CEO |

| 31 | EPAM Systems | 669 | $4.69 | Arkadiy Dobkin | 1993 | Co-Founder, CEO, Chairman, President |

| 32 | Antero Resources | 670 | $4.68 | Paul Rady | 2002 | Co-Founder, CEO, Chairman, President |

| 33 | Snap | 679 | $4.61 | Evan Spiegel | 2011 | Co-Founder, CEO, Director |

| 34 | Zoom Video Communications | 683 | $4.53 | Eric Yuan | 2011 | Founder, CEO, Chairman, President |

| 35 | Rivian Automotive | 692 | $4.43 | RJ Scaringe | 2009 | Founder, CEO |

| 36 | PriceSmart | 697 | $4.41 | Robert Price | 1993 | Co-Founder, CEO (until Sept. ‘25), Chairman |

| 37 | eXp World Holdings | 708 | $4.28 | Glenn Sanford | 2008 | Founder, CEO, Chairman |

| 38 | Toast | 766 | $3.87 | Aman Narang | 2012 | Co-Founder, CEO, Director |

| 39 | Akamai Technologies | 771 | $3.81 | Dr. Tom Leighton | 1998 | Co-Founder, CEO |

| 40 | ScanSource | 776 | $3.79 | Michael Baur | 1992 | Co-Founder, CEO, Chairman |

| 41 | Dream Finders Homes | 784 | $3.75 | Patrick Zalupski | 2008 | Co-Founder, CEO, Chairman, President |

| 42 | Century Communities | 794 | $3.69 | Robert Francescon | 2002 | Co-Founder, CEO, President, Director |

| 43 | Euronet Worldwide | 796 | $3.69 | Michael Brown | 1994 | Co-Founder, CEO, Chairman, President |

| 44 | DraftKings | 798 | $3.67 | Jason Robins | 2011 | Co-Founder, CEO, Chairman |

| 45 | Atlassian | 811 | $3.54 | Mike Cannon-Brookes | 2002 | Co-Founder, CEO |

| 46 | Roku | 820 | $3.49 | Anthony Wood | 2002 | Founder, CEO, Chairman |

| 47 | Cheesecake Factory | 828 | $3.44 | David Overton | 1972 | Co-Founder, CEO, Chairman |

| 48 | Chefs’ Warehouse | 830 | $3.43 | Christopher Pappas | 1985 | Co-Founder, CEO, Chairman, President |

| 49 | AppLovin | 847 | $3.28 | Adam Foroughi | 2012 | Co-Founder, CEO, Chairman |

| 50 | PACS Group | 869 | $3.11 | Jason Murray | 2013 | Co-Founder, CEO, Chairman |

| 51 | Coinbase Global | 870 | $3.11 | Brian Armstrong | 2012 | Co-Founder, CEO, Chairman |

| 52 | CrowdStrike | 883 | $3.06 | George Kurtz | 2011 | Founder, CEO |

| 53 | Matador Resources | 930 | $2.81 | Joseph Wm. Foran | 2003 | Founder, CEO, Chairman |

| 54 | Viasat | 932 | $2.80 | Mark Dankberg | 1986 | Co-Founder, CEO, Chairman |

| 55 | Roblox | 935 | $2.80 | David Baszucki | 2004 | Co-Founder, CEO |

| 56 | ProFrac Holding | 971 | $2.63 | Ladd Wilks | 2016 | Co-Founder, CEO |

| 57 | Playtika Holding | 982 | $2.57 | Robert Antokol | 2010 | Co-Founder, CEO, Chairman |

| 58 | Stagwell | 993 | $2.53 | Mark Penn | 2021 | Founder, CEO, Chairman |

| 59 | Dropbox | 997 | $2.50 | Drew Houston | 2007 | Co-Founder, CEO |

Sources:

Corporate Websites

-

Business Visualizations1 year ago

Business Visualizations1 year agoEverything Owned by Apple

-

Business Visualizations1 year ago

Business Visualizations1 year agoAmerica’s Most Valuable Companies Ranked by Profit per Employee

-

Business Visualizations11 months ago

Business Visualizations11 months agoThe Biggest Fortune 500 Company in Every State

-

Business Visualizations8 months ago

Business Visualizations8 months agoThe Biggest Employers by Industry

-

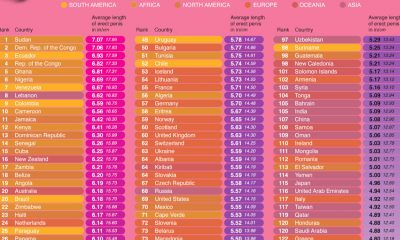

Maps2 years ago

Maps2 years agoPenis Lengths Around the World

-

Business Visualizations2 years ago

Business Visualizations2 years agoNew Animated Map Shows Airbnb’s Fully Booked Cities Along the 2024 Eclipse Path of Totality

-

Business Visualizations2 years ago

Business Visualizations2 years agoEverything the Luxury Giant LVMH Owns in One Chart

-

Business Visualizations2 years ago

Business Visualizations2 years agoTimeline Shows the Top 10 Most-Visited Websites Each Year Since 1995